Here are the key elements for obtaining a personal loan from a bank, as provided by Al Haditha Investment, specialists in factor analysis and assistance for persons seeking personal loans from financial institutions.

Al Haditha Investment has enumerated the requirements for obtaining a personal loan from a bank, along with a number of guidelines that are regarded as qualifying criteria.

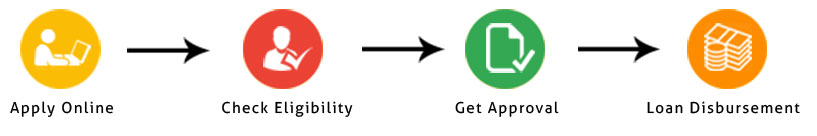

In order to avail Al Haditha Investment bank personal loan in Dubai, we Al Haditha Investment here listed steps would be helpful for individuals to apply for personal loan in Axis bank. These steps are much easier to do when compared with the procedure to avail loan from other banks.

| Service type | Interest rate |

|---|---|

| Rack Interest rates | 13.50% to 24% |

| Loan Processing charges | 1.50% to 2.00% + Service Tax as applicable |

| Pre payment Charges | Nil |

| Cheque bounce charges | AED. 500 per cheque bounce + Service Tax as applicable |

| Cheque / Instrument Swap charges | AED. 500 per instance+ Service Tax as applicable |

| Default Interest rate | 24% per annum i.e. 2% per month on overdue of installment |